Wills and legacy planning

Make your wishes known ahead of time, so you’re able to fulfill your faithful, caring, and charitable intentions.

No matter how large or small your estate, a will is a great place to start, ensuring your values are reflected in your planning. It’s a chance to care for those you love: family, friends, the church and missions you care about.

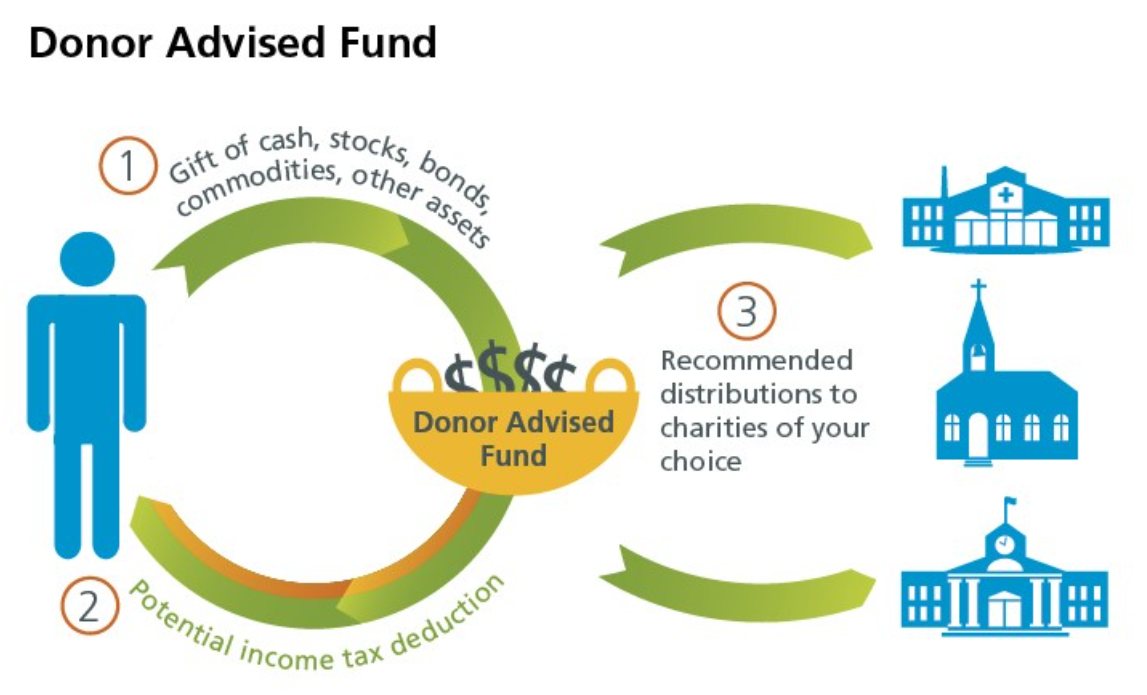

Donor advised fund

Tax-Smart tip: Do you use Itemized or Standard Deduction on your taxes? A Donor Advised Fund allows you to make a large charitable contribution one tax year, into a fund that you can dispense to your favorite charities over multiple years.

Invest & grow your giving fund tax-free from this account.

Other types of gifts

Retirement assets

Tax-smart tip: Give from your Retirement Fund! Your IRA, 401k, 403b, pension or other tax deferred plan, is an excellent way to make a gift to your chosen charities. Plus, you may satisfy your required minimum distributions and reduce taxable income.

Other types of gifts: stocks and bonds, real estate, life insurance, farm commodities, and valuable collections.

Appreciated Stocks and Securities

- Can help avoid capital gains on appreciated assets

- Receive a deduction for the full fair market value of the asset at the time of the gift

- Are deductible for up to 30% of adjusted gross income, with excess carried forward up to five years

- Can be given directly to Oxford Circle CCDA or through the Mennonite Foundation, an affiliate of Everence Financial. Please ask for Randy Nyce at 215-703-0111 for more information.

Charitable gift annuities

Do you have savings you would like to give in the future, but you still need income from?

A gift annuity is a gift planning option that lets you share your heart for our mission, receive a tax deduction now, and also receive steady payments for life.*

Charitable trusts

Make a gift that will also provide you and your family income.

Set aside and direct your assets to our organization and to your heirs – or even back to you – in a way that best fits your needs.

How you can support OCCCDA’s work through creative ways of giving:

Through planned giving, you can make the most significant gift of your life and support our mission and our work as you achieve your overall financial, tax and estate planning goals.

Planned gifts are just that: gifts that require some planning. These are significant tools that can help you give more, in tax-smart ways, and can provide income to you along with your gift. Stretch the possibilities of your support to us with the advantages of planned giving.

We’ve partnered with Everence® to help you in exploring your planned giving options. Take a look at the various ways you can grow your generosity – today and into the future.

For more information, contact:

- Katie Gard, OCCCDA Donor Relations, 267-225-8309, katie@occcda.org

- Randy Nyce, Everence Stewardship Consultant, at 215-703-0111, randy.nyce@everence.com

Everence Charitable Services is administered by Everence Foundation and Everence Trust Company.

*Gift annuity payments are dependent on the financial ability of the issuing entity to pay.

This information should be used only for preliminary guidance. Donors should consult their financial professional, attorneys and accountants.

Our partners at Everence made a video that features us! Check it out here: